Empowering ISOs to Succeed

Adaptable Funding Options

for Small Enterprises

Seeking business funds for your merchants?

Rowan Advance offers flexible financing, beyond credit scores. Send deals hassle-free today.

Fast Approvals

We blend cutting-edge technology with manual review to deliver a streamlined underwriting process at a higher than industry-standard approval rate.

Same Day Funding

Once approved, gain access to your funds right away. From Submission to Wire Sent in as little as 2 hours.

Up to $1,500,000

Need a lot of capital fast? For businesses that qualify, ask about our jumbo-product. Receive up to $1 Million within the day!

Striving for Financial Clarity and Confidence

Fast funding, flexible terms, unbeatable commissions.

Apply Fast

Our quick underwriting process provides approvals faster than most small business lenders.

Same-Day Funding

Gain access to the funds you need, fast – once you qualify for small business financing.

Up to $1,000,000

Get the capital you need to grow your business, without the burden of inflexible repayment terms.

High Commissions

Competitive rates, fast processing, and same-day commissions put more money in your pocket.

Bad Credit? Apply for

Hassle-Free Financing

Credit requirements often prevent business owners from getting the financing they need to get their small businesses off the ground. At Rowan Advance, our goal is to provide capital for small businesses by considering a range of factors beyond a poor credit score.

Need funding? We’ll provide the hassle-free financing you need with the best-in-class service you deserve.

Why Choose Rowan Advance?

Rowan Advance delivers fast, flexible funding with competitive rates, high commissions, and minimal stipulations. We prioritize same-day approvals, seamless processing, and early prepay discounts. Partner with us for a smooth, rewarding funding experience.

Competitive rates starting from 1.28.

Same-day commissions on every deal.

Flexible terms from 8 to 12 months.

Minimal stipulations for quicker approvals.

Early prepay discounts for merchants.

Why Choose Rowan Advance?

Rowan Advance delivers fast, flexible funding with competitive rates, high commissions, and minimal stipulations. We prioritize same-day approvals, seamless processing, and early prepay discounts. Partner with us for a smooth, rewarding funding experience.

Competitive rates starting from 1.279.

Same-day commissions on every deal.

Flexible terms up to 54 weeks.

Minimal stipulations for quicker approvals.

Early prepay discounts for merchants.

Providing The Simplest Solution For The Most Complex Problem

1500+

Merchants Served

Trusted by over 1,500 businesses, we provide fast and reliable funding solutions tailored to diverse financial needs.

100+

Industries Covered

From retail to healthcare, we support businesses across 30+ industries with flexible funding options to fuel their growth.

$250m+

Deals Funded

Over $10 million in funding delivered monthly and $250 million funded in over two years.

300+

5-Star Reviews

Highly rated by partners and clients, our exceptional service and funding solutions have earned over 300 five-star reviews.

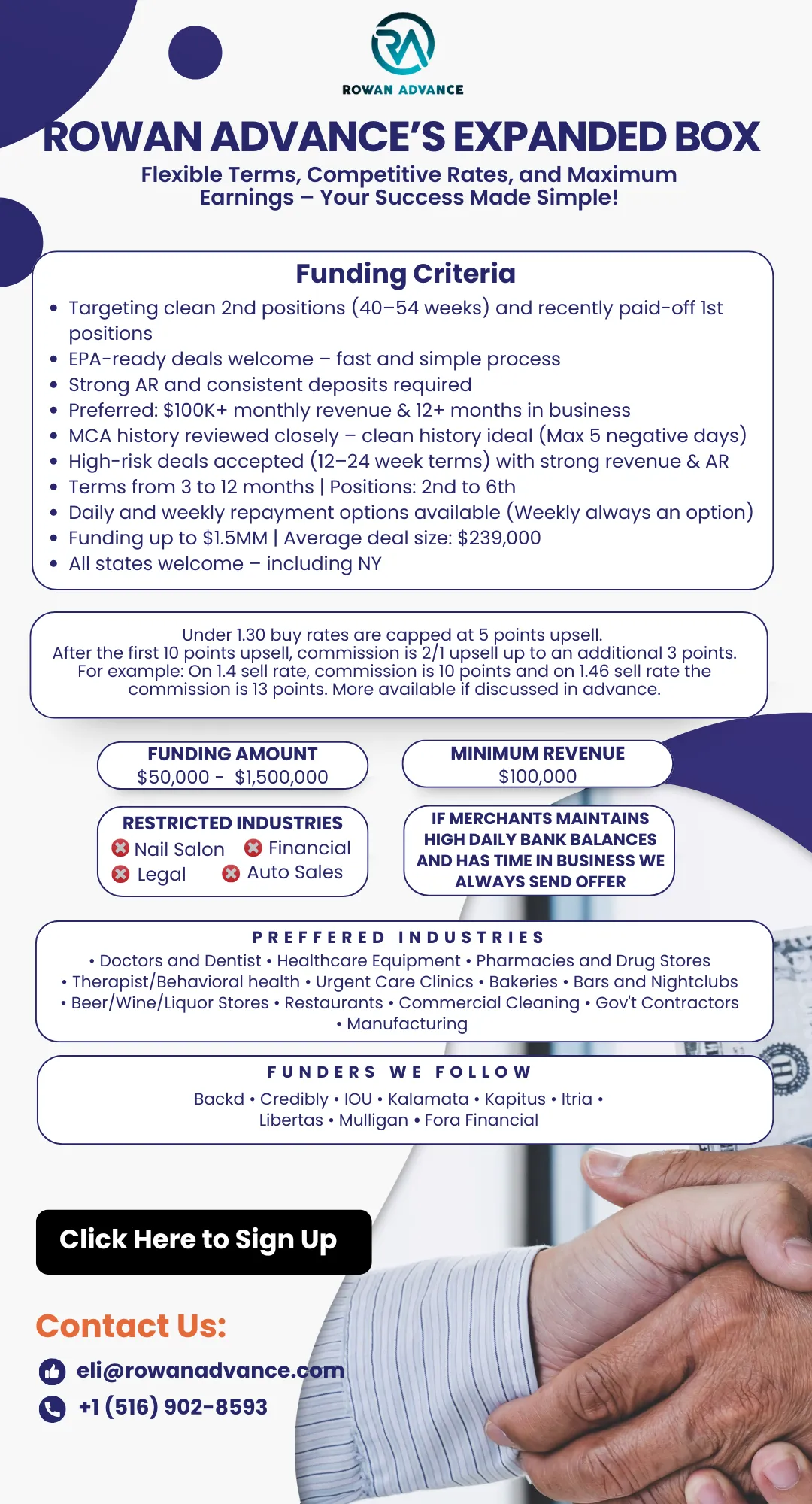

Our Underwriting Guidelines

✅ Funding Criteria

• Targeting clean 2nd positions (40–54 weeks) or recently paid-off 1st positions

• EPA-ready deals welcome – fast, simple process

• Must show consistent deposits & accounts receivable

• Strong revenue ($100K+/month) and established time in business preferred

• MCA history reviewed closely

• High-risk deals accepted (12–24 week terms) with strong AR & revenue

• Daily and weekly repayment options available

• Funding up to $1.5MM

• Average Deal Size: $239,000

• Clean MCA history

• Terms: 3–12 months

• All states including NY

• Max 5 negative days

• 12 months in business

• Weekly payments is always an option

Program Requirements

Funding Amount: $50,000 – $1,500,000

Minimum Revenue: $100,000

Restricted Industries

❌ Nail Salons

❌ Financial

❌ Legal

❌ Auto Sales

Preferred Industries

Doctors and Dentists, Healthcare Equipment, Pharmacies and Drug Stores, Therapist/Behavioral Health, Urgent Care Clinics, Bakeries, Bars and Nightclubs, Beer/Wine/Liquor Stores, Restaurants, Commercial Cleaning, Government Contractors, Manufacturing

Blogs and Articles

🛑 SBA Shuts Down MCA Refinancing: What It Means for Small Businesses & Brokers

Big News from the SBA: MCA Debt No Longer Eligible for Refinancing

As of June 1, 2025, the U.S. Small Business Administration (SBA) has made a decisive change to its 7(a) loan program: Merchant Cash Advances (MCAs) and factoring arrangements can no longer be refinanced using SBA-backed capital.

This shift has major implications for small business owners, lenders, and ISO brokers nationwide.

What Changed?

In its most recent update, the SBA explicitly stated that MCA debt and factoring are ineligible for debt refinance under 7(a) loan guidelines. This means:

SBA lenders cannot use 7(a) loan proceeds to pay off any existing MCA obligations.

MCA-related balances are now treated as "ineligible debt" in SBA loan applications.

Underwriters are being instructed to disqualify deals involving MCA payoff strategies.

This policy shift was confirmed by multiple lending platforms, including FastwaySBA, and is already being enforced by banks and non-bank SBA lenders.

Why It Matters

Over the past few years, many small businesses struggling with high-cost MCA balances looked to the SBA’s lower-interest loans as a way to consolidate debt and regain financial stability.

Now, with the door closed:

Business owners carrying MCA debt lose a valuable exit strategy.

Loan brokers and ISO partners must be more selective with the deals they bring to SBA lenders.

Debt restructuring options are shrinking, especially for distressed companies.

Industry Reaction

This change is part of a broader push by regulators to distinguish regulated lending from non-bank cash advance products. While MCAs are not technically classified as loans in many jurisdictions, the SBA is treating them as high-risk financial obligations that don't qualify for federally backed relief.

In related discussions on Reddit, business owners have expressed concern about being “stuck” in their MCA positions without a viable path forward.

Rowan Advance’s Take

“We’ve always believed in offering structured, transparent funding that helps small businesses—not traps them. This SBA update reinforces why our model is the right one,” said a senior funding specialist at Rowan Advance.

At Rowan Advance, our focus is on realistic, revenue-based financing that empowers small businesses. That means:

Clear, fixed repayment terms

No compounding interest

Factor rates starting at 1.28

Terms from 8 to 12 months

Early payoff discounts—not penalties

And for ISO brokers: We offer same-day commissions, up to 12 points, and a compliance-first underwriting process that fits the current regulatory landscape.

What Business Owners Should Do Now

If you're currently carrying MCA debt and were considering an SBA loan to refinance it, here are your next steps:

✅ Talk to a qualified funding partner who understands your current capital stack

✅ Explore non-SBA alternatives—revenue-based financing, consolidation loans, or structured settlements

✅ Avoid stacking additional MCA debt without a long-term plan

Final Thought

The SBA’s new policy is a wake-up call: Not all capital is created equal.

At Rowan Advance, we’re committed to providing funding solutions that make sense today—and hold up tomorrow. If you're a small business owner or an ISO broker navigating these changes, we’re here to help you structure smarter, safer deals in this new funding environment.

Empowering ISOs to Succeed

Can you tell me more about Rowan Advance?

Rowan Advance is a trusted funding partner for ISO brokers, providing fast, flexible, and high-commission financing solutions for your merchants. We prioritize transparency, efficiency, and strong partnerships, ensuring that you and your clients receive the best possible terms. With competitive rates, same-day approvals, and a seamless funding process, we help you close more deals and maximize your earnings.

Can you help my business access funding?

Absolutely! Rowan Advance specializes in providing revenue-based financing for merchants in various industries. We move quickly—offering fast approvals, minimal stipulations, and same-day commissions—so you can get your deals funded without delays. Whether your merchants need capital for expansion, payroll, inventory, or cash flow, we structure deals that work for them.

How much capital can my merchants access through Rowan Advance?

Rowan Advance funds deals from $10,000 up to $5 million, depending on the merchant’s financial profile, revenue, and funding history. Whether they need a small working capital boost or a larger expansion fund, we offer flexible terms that help you secure the best deal for them.

What are the rates and commissions on your funding?

We offer competitive factor rates starting at 1.28, with commissions up to 12 points. Our deals come with early prepay discounts, same-day commissions, and a commitment to matching lower offers. That means you can maximize your earnings while ensuring your merchants get the best funding solution available. Reach out today to start submitting deals!

© 2025 Rowan Advance

Contact Our Team

Eli Sklar - Senior ISO Relations

Call me at: +1 (516) 902‑8593

Mail me at: [email protected]